What are BSE / NSE Market Timings, Trading Hours, Opening and Closing Time

BSE / NSE Normal Market Opening Time: 09:15 hours

BSE / NSE Normal Market Closing Time: 15:30 hours

Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) remain open for equity trading on all weekdays from Monday to Friday for 6.15 hours.

Also Note:

Markets remain closed on declared holidays.

Special trading sessions are announced by the exchange on time to time though public notices.

Special trading session is also arranged for Diwali Muhurat Trading if that doesn’t fall under normal trading hours. Check Diwali Muhurat Trading Timings.

what is the difference between stock holder and stake holder

Stockholder (Shareholder) vs. Stakeholder

- A shareholder is always a stakeholder but a stakeholder can or cannot be the shareholder in a company.

- A shareholder has at least one stock in the public company and interest in stock performance, whereas stakeholder has an interest in the company’s performance.

- A shareholder can be an institution, company and individual holding the stocks and a stakeholder can be employees, supplier, owner, vendors, customers, and bondholders.

- A shareholder can buy or sell the stocks frequently based on their needs, but stakeholders are concerned with the long term need and performance of the company.

Why do share prices move up and down

The answer in two words is “Demand & Supply“. Simply if there is more demand of a company shares and less people are willing to sell them, the share will move upwards. If there is a huge supply but no body is interested in buying shares at the current price, the share will move downwards.

Now the major question is how does demand or additional supply comes in to the market and the answer is, there are many factors involve in this including company’s financial result, overall economy situations, sector performance, government rules & regulations, major political & natural events, future of the company, upcoming products & services, company management changes, stock market frauds etc.

Any of the above and many more factors affect demand & supply of a company stock and ultimately move it prices to go up & down.

It’s very hard to predict stock movement and require lots of research and expertise.

What is face value

Face value is an arbitrary value of the securities determined by the issuer to analyse the growth and needs in real numbers on the balance sheets. For example, if the company has a requirement of Rs 20 lakh, it can decide the face value of the stocks at Rs 10 and issue 2 lakh shares to raise funds. With the company’s growth and investor sentiments, the value of stocks increases or decrease significantly.

What is MID CAP

According to the current market, companies are categories in large-cap, mid-cap and small-cap companies. Company’s capitalization is calculated on the basis of the total number of its outstanding shares in the market multiplied by the current price per share.

For the mid-cap companies market capitalization lies between Rs 5,000 – 20,000cr. Mid-cap companies are considerably smaller than large-cap companies in comparison to revenue, profitability, employees, client base, etc.

What is ISIN Number

What is Securities Transaction Tax (STT)

Securities Transaction Tax (STT) is a tax being levied on all transactions done on the stock exchanges.

Securities Transaction Tax is applicable on purchase or sale of equity shares, derivatives, equity oriented funds and equity oriented Mutual Funds.

Current STT on purchase or sell of an equity share is 0.075%.

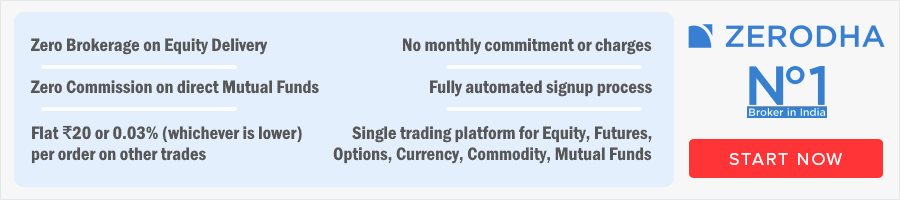

who is a Broker in Stock Market

A broker is a member of a stock exchange, who is permitted to do equity trades in there. Broker is enrolled member of the exchange and is registered with SEBI.

In other word broker is an intermediate person (or a company) between an investor and a stock exchange. They buy & sell shares and other securities for investors in stock market.

Please note that an investor cannot direct deal with stock exchange.

How much returns can I expect from the market

Your stock portfolio will always consist of multiple stocks. At any particular time, some stocks will perform excellently well, while some will not. Your portfolio returns will be the average of both.

During a good market, your portfolio can give you a return as high as 30-35% (the benchmark index nifty alone gave a return of over 26% in a year). However, during a bad market- the returns can be as low as 2-5% (maybe even negative).

If you sum up everything, you can expect an annual return of 15-18%, depending on how good you were at picking stocks. Nevertheless, you can generate even better return if you are ready to put some hard work.

How many stocks should I buy

Your portfolio should not be over or under diversified. Do not invest all your money in a single stock as it increases the risk in your portfolio. Diversify your portfolio by purchasing multiple stocks from different industries.

In general, you should not buy more than 8-10 stocks as it becomes really difficult for a retail investor to monitor more stocks. Besides, over-diversification kills the profit.

What kind of stocks should I avoid

You should avoid investing in stocks with low liquidity. There are a number of small-cap stocks where the prices may be continuously falling, but the investors are not able to sell that stock just because there are no buyers. Avoid investing in companies with low liquidity.

Further, for the beginners- I would also advise avoiding investing in penny stocks. These companies are very risky and prone to different scams like pump and dump etc.

What is MFSS in Stock Market

what is Book Bulding in Stock Market

what is Bid ask Bounce in Stock Market

what is Market Price in Stock market

what is Portfolio in stock market

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly tradable securities, like real estate, art, and private investments.

What is Index in stock market

What is Price and Volume

Close Price

This is the close price of the stock on the last day it traded

1M Return

This is the percentage change in the company’s stock price over the previous 4 weeks

6M Return

This is the percentage change in the company’s stock price over the previous 26 weeks

1Y Return

This is the percentage change in the company’s stock price over the previous 52 weeks

1M Return vs Nifty

This is the percentage change in the company’s stock price minus percentage change in Nifty over the previous 4 weeks

A positive output, when the market has moved up over the previous 4 weeks, indicates that the company’s stock price moved up at a faster pace compared to the pace of market movement. A positive output, when market has dropped during the previous 4 week, indicates that either the stock price moved up defying the market or it dropped at a slower pace than the market

A negative number indicates that either the market rose at a faster pace compared to stock price movement or dropped slower compared to stock price

6M Return vs Nifty

This is the percentage change in the company’s stock price minus percentage change in Nifty over the previous 26 weeks

EV / EBITDA

EV / EBITDA stands for Enterprise value (EV) divided by Earnings before interest, taxes and depreciation (EBITDA).

EV is a measure of the company’s total value and can be considered as the sum of money that needs to paid to all the stakeholders by the acquirer if he/she intends to buy the company today.

EBITDA is a measure of the company’s operating performance. It indicates the amount of profit the company earned via its core business operations before paying interest expense, taxes etc.

Suppose EV of a company is Rs.10,000 and EBITDA for the previous financial year was Rs.2,500. EV/EBITDA of the company is 10,000 / 2,500 = 4.0x.

EV/EBITDA is a valuation ratio and helps understand whether the company is overvalued or undervalued. The best way to use a EV/EBITDA ratio is by comparing the ratio of different companies operating in the same sector. A company with lower EV/EBITDA is considered to be undervalued in comparison with company with higher EV/EBITDA. However it is important to understand the reason behind the undervaluation. Suppose company A has EV/EBITDA of 4.0x whereas company B has EV/EBITDA of 6.3x. If the market is expecting B to grow at a faster rate, higher valuation for the same is justified. However suppose market has not understood company A’s potential correctly, then the lower valuation multiple is justified and presents a buying opportunity of the stock. If market has ignored A because of poor earnings or bad management practice, it is better to ignore the same in spite of relative cheapness.

What is PS Ratio

The item is defined as close price of the stock divided by the revenue per share of the company for the most recent financial year. The ratio indicates the number of number of units of stock price to be expended to purchase 1 unit of revenue per share. Suppose revenue of the company is Rs.100,000, shares outstanding is 500 and stock price is Rs.100. PS ratio is calculated as 100/ (100,000/500) = 0.5x. So it costs Rs. 0.5 to purchase every Rupee of the company’s revenue

PS ratio is a valuation ratio and is used in lieu of PE ratio. When a company is loss making, EPS becomes negative and calculating PE ratio is not possible. In such a scenario PS ratio can be used. Just as in PE ratio, PS ratio is used by comparing the ratio of 2 or more companies operating in the same sector. The lower the ratio, the more undervalued the company. However one has to understand the reasons behind undervaluation before deciding whether the stock has investment potential

What is Dividend Yield

The ratio is calculated as dividend per share (DPS) for the most recent financial year divided by the close price of the stock. Dividend is the portion of company’s profit that is paid out to shareholders. Dividend per share (DPS) refers to the total dividend paid out divided by the common stock of the company

Suppose DPS is Rs.16 and stock price is Rs.250, dividend yield is calculated as (16/250)*100 = 6.4%

The ratio is used to calculate the earning on investment considering only dividends declared. Higher the dividend yield the better. One should always consider dividend yield when investing in a company’s stock, as it can be significant part of the return that might be generated. High dividend yield stocks could be a good investment avenue to supplement any income needs

What is PB Ratio

This ratio is calculated as recent close price of the stock divided by book value per share of the company for the most recent financial year. Book value per share refers to the total shareholders investment in the company divided by shares outstanding

The ratio helps understand the unit price to be paid for the assets leftover after paying all liabilities of the company. Suppose the company has total assets of Rs.250. These assets have been purchased using Rs.180 of debt and Rs.70 shareholders equity. Hence if all liabilities of the company are to be paid off, Rs.180 worth of assets will have to be sold and Rs.70 will remain on the books of the company. If the share price of the company is Rs.300, PB ratio will be calculated as 300 / 70 = 4.3x

Just as in PE ratio, PB ratio is used for valuation purposes, specially in case of banks and financial companies. Non banking companies do carry large amount of assets on their books, however these assets are not valued on a regular basis, hence there is usually a huge divergence between book value and market value of the assets. On the contrary banks and financial companies regularly value the assets they carry on their books. Hence using PB ratio to value such companies is more appropriate and relevant

A low PB stock is considered to be undervalued compared to a higher PB one. However it is important to further analyse the reasons behind undervaluation before deciding to buy the stock

What is Forward PE Ratio

Forward PE ratio is calculated as close price of the stock divided by estimated earnings per share of the company for the current financial year. If the current stock price is Rs.300 and estimated EPS of the company for the current financial year is Rs.8, then forward PE ratio is 300/8 = 37.5

Forward PE ratio can be used to compare it with the current PE ratio of the company. Suppose current PE ratio of company A is 15 and the forward PE ratio is 12, it indicates that EPS of the company is expected to grow over the next year. The deeper the discount between current PE ratio and the forward PE ratio, the higher the potential for the stock price to increase

What is PE Ratio

PE ratio is calculated as close price of the stock divided by the earnings per share excluding extraordinary items for the most recent financial year. The ratio indicates the number of units of stock price it takes to purchase a single unit of the company’s earnings per share (EPS). If the company is currently trading at Rs.300/share and EPS of the company is Rs.30, then the PE ratio is 300/30 = 10x. So it costs Rs.10 to be eligible to purchase Re.1 of the company’s earnings

What is GDP(Gross Domestic Product)

Gross Domestic Product (GDP) is the most common measure to estimate the size of a country’s economy. It represents the total value of final goods and services produced domestically, in a given time period. India’s GDP was approximately USD 2.3 trillion for financial year 2015. What this means is that the total value of final goods and services produced inside the geographical boundary of India between April 2014 and March 2015 was USD 2.3 trillion.

what is SLM in Stock market

what is SL in Stock Market

what is AMO in Stock Market

what is CNC in Stock Market

what is MIS in Stock Market

what is Intraday Trading

Intraday trading as the name suggests refers to the trading system where you have to square-off your trade on the same day.Squaring off the trade means that you have to do the buy and sell or sell and buy transaction on the same day before the market close.Intraday Trading is also referred to as Day trading.

what is OCO in Stock Market

what is CO in Stock Market

What is LTP in Stock Market

What is P&L in Stock Market

Types of Candlesticks

what are Candlesticks in the Stock Market

what is Futures and Options(F&O) in Stock Market

F&O is an abbreviation for Futures and Options. Futures and Options are derivatives products. Definition: Derivatives are securities which derive their value from one or other underlying securities. Simple explanation: A derivative is like buying financial product whose value is derived from the real asset.

What Is Short Selling

What Is a Secondary Market

The secondary market is where investors buy and sell securities they already own. It is what most people typically think of as the “stock market,” though stocks are also sold on the primary market when they are first issued. The national exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ, are secondary markets.

What Is a Primary Market

A primary market issues new securities on an exchange for companies, governments, and other groups to obtain financing through debt-based or equity-based securities. Primary markets are facilitated by underwriting groups consisting of investment banks that set a beginning price range for a given security and oversee its sale to investors.

what is a Bear Market

A bear market is a condition in which securities prices fall 20% or more from recent highs amid widespread pessimism and negative investor sentiment. Typically, bear markets are associated with declines in an overall market or index like the S&P 500, but individual securities or commodities can be considered to be in a bear market if they experience a decline of 20% or more over a sustained period of time – typically two months or more.

What is a Bull Market

A bull market is the condition of a financial market of a group of securities in which prices are rising or are expected to rise. The term “bull market” is most often used to refer to the stock market but can be applied to anything that is traded, such as bonds, real estate, currencies and commodities. Because prices of securities rise and fall essentially continuously during trading, the term “bull market” is typically reserved for extended periods in which a large portion of security prices are rising. Bull markets tend to last for months or even years.

what is a Mutual Fund

what is Target Price

what is Stop Loss

what is Dividend in Stock Market

A stock dividend is a dividend payment made in the form of additional shares rather than a cash payout. … These distributions are generally acknowledged in the form of fractions paid per existing share, such as if a company issued a stock dividend of 0.05 shares for each single share held by existing shareholders.

what is IPO

what is Intraday Trading in Stock Market

what are Technical Indicators in Stocks

what are Blue Chip stocks

what is Penny Stocks

Penny stocks are those that trade at a very low price, have very low market capitalisation, are mostly illiquid, and are usually listed on a smaller exchange. Penny stocks in the Indian stock market can have prices below Rs 10. These stocks are very speculative in nature and are considered highly risky because of lack of liquidity, smaller number of shareholders, large bid-ask spreads and limited disclosure of information.

what is Technical Analysis

what is Fundamental Analysis

what is Nifty

what is Sensex

what is SEBI

Securities and Exchange Board of India (SEBI), is a statutory regulatory body established by an Act of Parliament, to protect the interests of investors in securities, to promote the development of and to regulate the securities market. In simple terms, SEBI is the regulatory body of securities markets.

what is Stock Exchange

what is Trading account

what is Demat account

what is stock market

What is Stocks

What is Emerging Markets

What is National Stock Exchange of India(NSE)

The National Stock Exchange of India Limited (NSE) is the leading stock exchange India, located in Mumbai. The NSE was established in 1992 as the first dematerialized electronic exchange in the country. NSE was the first exchange in the country to provide a modern, fully automated screen-based electronic trading system which offered easy trading facility to the investors spread across the length and breadth of the country. Vikram Limaye is Managing Director & Chief Executive Officer of NSE.

National Stock Exchange has a total market capitalization of more than US$2.27 trillion, making it the world’s 11th-largest stock exchange as of April 2018. NSE’s flagship index, the NIFTY 50, the 50 stock index is used extensively by investors in India and around the world as a barometer of the Indian capital markets. Nifty 50 index was launched in 1996 by the NSE.However, Vaidyanathan (2016) estimates that only about 4% of the Indian economy / GDP is actually derived from the stock exchanges in India.

Unlike countries like the United States where nearly 70% of the GDP is derived from larger companies and the corporate sector, the corporate sector in India accounts for only 12-14% of the national GDP (as of October 2016). Of these only 7,800 companies are listed of which only 4000 trade on the stock exchanges at BSE and NSE. Hence the stocks trading at the BSE and NSE account for only around 4% of the Indian economy, which derives most of its income related activity from the so-called unorganized sector and households.

Economic Times estimated that as of April 2018, 60 million (6 crore) retail investors had invested their savings in stocks in India, either through direct purchases of equities or through mutual funds.Earlier, the Bimal Jalan Committee report estimated that barely 1.3% of India’s population invested in the stock market, as compared to 27% in USA and 10% in China.

What is Bombay Stock Exchange (BSE)

The Bombay Stock Exchange (BSE) is the first and largest securities market in India and was established in 1875 as the Native Share and Stock Brokers’ Association. Based in Mumbai, India, the BSE lists close to 6,000 companies and is one of the largest exchanges in the world, along with the New York Stock Exchange (NYSE), NASDAQ, London Stock Exchange Group, Japan Exchange Group, and Shanghai Stock Exchange.

The BSE has helped develop the country’s capital markets, including the retail debt market, and helped grow the Indian corporate sector.